Investment in Real Estate Development in the First Half of 2025

1. The Completion of Investment in Real Estate Development

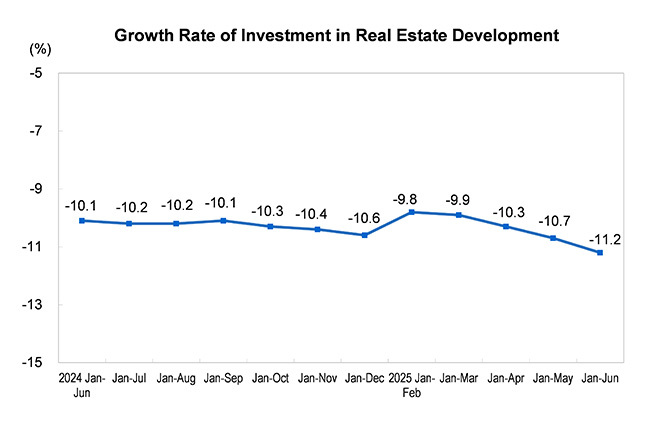

From January to June, investment in real estate development was 4,665.8 billion yuan, a year-on-year decrease of 11.2 percent (calculated on a comparable basis, see Annotation 6 for details), of which the investment in residential buildings was 3,577 billion yuan, down by 10.4 percent.

From January to June, the floor space of buildings under construction by real estate development enterprises was 6,333.21 million square meters, down by 9.1 percent year on year, of which the floor space of residential buildings under construction was 4,412.4 million square meters, down by 9.4 percent. The floor space of buildings newly started was 303.64 million square meters, down by 20.0 percent, of which the floor space of residential buildings newly started was 222.88 million square meters, down by 19.6 percent. The floor space of buildings completed was 225.67 million square meters, down by 14.8 percent, of which the floor space of residential buildings completed was 162.66 million square meters, down by 15.5 percent.

2. Sales and Inventory of Newly Built Commercial Buildings

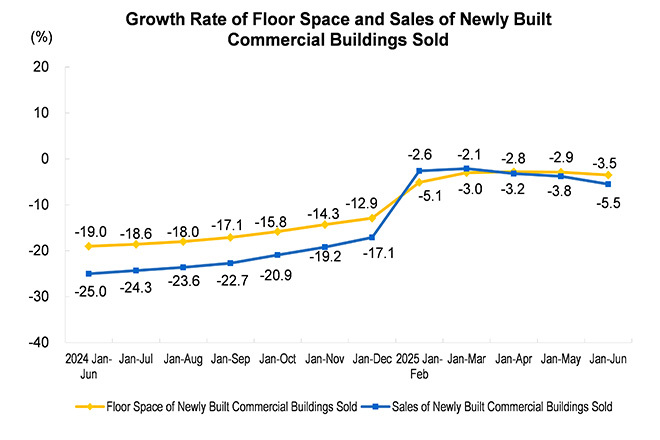

From January to June, the floor space of newly built commercial buildings sold was 458.51 million square meters, down by 3.5 percent year on year; of which the floor space of residential buildings sold decreased by 3.7 percent. The sales of newly built commercial buildings were 4,424.1 billion yuan, down by 5.5 percent; of which the sales of residential buildings decreased by 5.2 percent.

At the end of June, the floor space of commercial buildings for sale was 769.48 million square meters, with a decrease of 4.79 million square meters compared to the end of May; of which the floor space of residential buildings for sale decreased by 4.43 million square meters.

3. Funds in Place of Enterprises for Real Estate Development

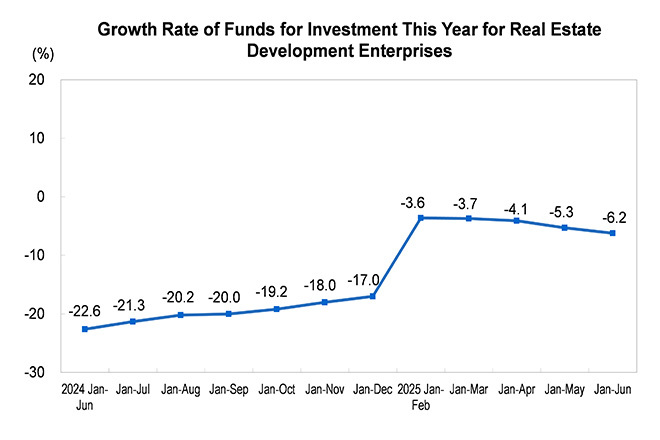

From January to June, the funds allocated for investment in real estate development enterprises this year were 5,020.2 billion yuan, down by 6.2 percent year on year. Among them, domestic loans were 824.5 billion yuan, up by 0.6 percent; the foreign investment was 1.7 billion yuan, up by 25.4 percent; self-raised funds were 1,754.4 billion yuan, down by 7.2 percent; deposits and advance receipts were 1,478.1 billion yuan, down by 7.5 percent; and individual mortgage loans were 684.7 billion yuan, down by 11.4 percent.

4. National Real Estate Climate Index

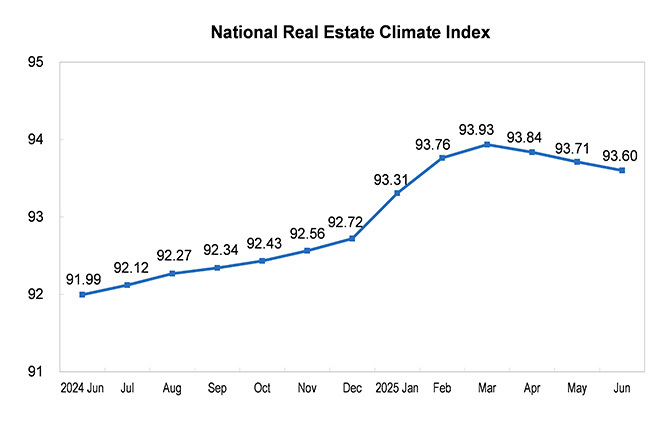

In June, the national real estate climate index was 93.60.

Real Estate Development and Sales from January to June 2025

|

Indicators |

Absolute Value |

Growth Rate Y/Y (%) |

|

Investment in real estate development (100 million yuan) |

46658 |

-11.2 |

|

Of which: Residential buildings |

35770 |

-10.4 |

|

Office buildings |

1792 |

-16.8 |

|

Buildings for commercial business |

3294 |

-8.4 |

|

Floor space of buildings under construction (10,000 sq.m) |

633321 |

-9.1 |

|

Of which: Residential buildings |

441240 |

-9.4 |

|

Office buildings |

27122 |

-5.1 |

|

Buildings for commercial business |

55337 |

-8.8 |

|

Floor space of buildings newly started (10,000 sq.m) |

30364 |

-20.0 |

|

Of which: Residential buildings |

22288 |

-19.6 |

|

Office buildings |

753 |

-21.0 |

|

Buildings for commercial business |

1956 |

-17.7 |

|

Floor space of buildings completed (10,000 sq.m) |

22567 |

-14.8 |

|

Of which: Residential buildings |

16266 |

-15.5 |

|

Office buildings |

734 |

0.2 |

|

Buildings for commercial business |

1590 |

-20.7 |

|

Floor space of newly built commercial buildings sold (10,000 sq.m) |

45851 |

-3.5 |

|

Of which: Residential buildings |

38358 |

-3.7 |

|

Office buildings |

1160 |

-3.0 |

|

Buildings for commercial business |

2697 |

-4.8 |

|

Sales of newly built commercial buildings (100 million yuan) |

44241 |

-5.5 |

|

Of which: Residential buildings |

38849 |

-5.2 |

|

Office buildings |

1497 |

-4.2 |

|

Buildings for commercial business |

2524 |

-10.4 |

|

Floor space of commercial buildings for sale (10,000 sq.m) |

76948 |

4.1 |

|

Of which: Residential buildings |

40821 |

6.5 |

|

Office buildings |

5153 |

-1.1 |

|

Buildings for commercial business |

14340 |

0.5 |

|

Funds in place in the year of enterprises for real estate development (100 million yuan) |

50202 |

-6.2 |

|

Of which: Domestic loans |

8245 |

0.6 |

|

Foreign investment |

17 |

25.4 |

|

Self-raised funds |

17544 |

-7.2 |

|

Deposits and advance receipts |

14781 |

-7.5 |

|

Individual mortgage loans |

6847 |

-11.4 |

Real Estate Investment in Eastern, Central, Western and Northeastern Regions from January to June 2025

|

Regions |

Investment (100 million yuan) |

|

Growth Rate Y/Y (%) |

|

|

Residential Buildings |

Residential Buildings | |||

|

National Total |

46658 |

35770 |

-11.2 |

-10.4 |

|

Eastern |

27635 |

20673 |

-12.8 |

-11.9 |

|

Central |

9412 |

7605 |

-10.0 |

-10.9 |

|

Western |

8673 |

6757 |

-5.4 |

-3.0 |

|

Northeastern |

938 |

735 |

-22.3 |

-22.5 |

Sales of Commercial Buildings in Eastern, Central, Western and Northeastern Regions from January to June 2025

|

Regions |

Floor Space of Newly Built Commercial Buildings Sold |

Sales of Newly Built Commercial Buildings | ||

|

Absolute Value (10,000 sq.m) |

Growth Rate Y/Y (%) |

Absolute Value (100 million yuan) |

Growth Rate Y/Y (%) | |

|

National Total |

45851 |

-3.5 |

44241 |

-5.5 |

|

Eastern |

20800 |

-5.2 |

26945 |

-5.8 |

|

Central |

11926 |

-1.2 |

7988 |

-5.8 |

|

Western |

11515 |

-2.5 |

8163 |

-4.3 |

|

Northeastern |

1610 |

-6.0 |

1146 |

-4.5 |

|

Note: Due to the rounding-off reasons, the regional subentries may not add up to the aggregate totals. | ||||

Annotations:

1. Explanatory Notes

Investment Completed by Real Estate Development Enterprises in the Year: refers to the investment made by real estate development enterprises in the construction of buildings, development of land, nonprofit buildings and value of land purchased. The index is cumulatively statistical data.

Floor Space of Newly-built Commercial Buildings Sold: refers to the total contracted area of commercial buildings (i.e. area of floor space as designated in the formal contracts signed by both sides) sold during the reporting period. The index is cumulatively statistical data.

Total Sale of Newly-built Commercial Buildings: refers to the total contracted value (i.e. value of sales/purchase for selling/purchase of commercial buildings as designated in the contract signed by both sides) received from the sales of the buildings during the reporting period. This index is cumulative data, on the same comparable basis as the floor space of newly built commercial buildings sold.

Floor Space of Commercial Buildings for Sale: refers to the area of commercial housing that has not been sold or leased among the completed construction areas of commercial housing available for sale or lease at the end of the reporting period, including the area of housing completed in the previous year and the current period, but excluding the floor area of buildings that cannot be sold or leased, such as those are demolished to rebuilt, unified and agent-construction, public supporting buildings, self-used by real estate enterprises and relocation houses that have been completed in the reporting period.

Funds in Place in the year of Enterprises for Real Estate Development: refers to the total amount available for real estate development regardless of kinds of currencies in the reporting period. Specifically, it includes domestic loans, foreign investment, self-raised funds, deposit and advance payment, individual mortgage loan and other types of financing. The index is cumulatively statistical data.

Floor Space of Buildings under Construction: refers to the total space area of the buildings under construction in the reporting period by real estate development enterprises. It includes buildings started in the year, continued from the previous year, suspended in earlier years but restarted in the year, completed in the year, and buildings under construction but suspended in the year. The floor space of a multi-storied building refers to the sum of floor space of all the stories.

Newly Started Floor Space of Buildings: refers to the area of buildings newly started for construction by real estate development enterprises during the reporting period, with each unit project as the accounting object. It does not include the floor space of buildings that commenced construction in the previous period and continued into the current reporting period or buildings that were suspended or delayed in the previous period and resumed construction in the current period. The start of construction is defined by the date when the building officially begins earth excavation (foundation treatment or driving of permanent piles). Newly started floor space refers to the total floor area of the entire building and cannot be calculated separately.

Floor Space of Buildings Completed: refers to the total floor space area of each building completed in the reporting period, which meet the requirements as designed, up to the standard for being resided in and put into use, has been checked and accepted by departments concerned as qualified or up to the standard of buildings completed and can be handed over for putting into use.

2. Statistics Coverage

All legal entities of real estate development with operational activities.

3. Survey Methods

Collect monthly with complete enumeration (no report in January).

4. Brief Description on National Real Estate Climate Index

The national real estate climate index follows the theory of economic cycle fluctuation, based on the business cycle theory and business cycle analysis, using time series, multivariate statistics, econometric analysis, taking investment in real estate development as the benchmarks, selecting related indicators such as real estate investment, capital, area, sales, excluding the impact of seasonal factors, including random factors, compiled by adopting the growth rate cycles method. The historical data will be revised monthly according to the newly added data. The national real estate climate index selected 2012 as the base year, and its growth rate was set at 100. Typically, the most appropriate level of the national real estate climate index is 100, the moderate level is between 95 and 105, the lower level is below 95, and the higher level is above 105.

5. Division on Eastern, Central, Western and Northeastern Regions

The eastern region includes Beijing, Tianjin, Hebei, Shanghai, Jiangsu, Zhejiang, Fujian, Shandong, Guangdong, and Hainan; the central region includes Shanxi, Anhui, Jiangxi, Henan, Hubei, and Hunan; the western region includes Inner Mongolia, Guangxi, Chongqing, Sichuan, Guizhou, Yunnan, Xizang, Shaanxi, Gansu, Qinghai, Ningxia, and Xinjiang; the northeastern region includes Liaoning, Jilin, and Heilongjiang.

6. Explanation of Year-on-Year Growth Rate

In compliance with the real estate development statistical system and regulations on statistical law enforcement inspections, the data on investment in real estate development and the floor space of newly built commercial buildings sold during the same period of the previous year have been revised to ensure accuracy. The growth rates are calculated on a comparable basis.