Purchasing Managers Index for July 2022

Department of Service Statistics of NBS

China Federation of Logistics and Purchasing(CFLP)

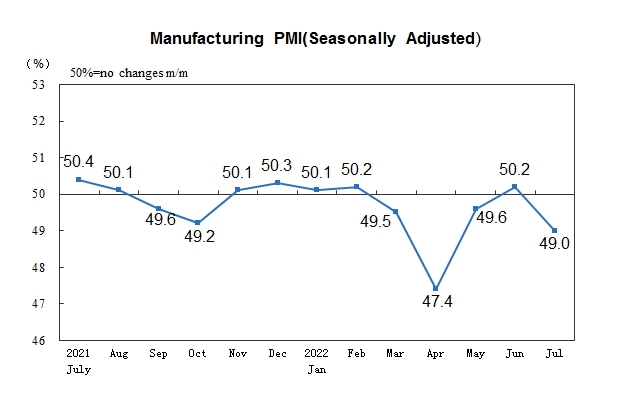

1. Manufacturing Purchasing Managers Index

In July, the Purchasing Manager Index (PMI) of China's manufacturing industry was 49.0 percent, down 1.2 percentage points from the previous month, below the threshold, and the prosperity level of the manufacturing industry fell.

In terms of enterprise size, the PMI of large and medium-sized enterprises was 49.8 and 48.5 percent respectively, down 0.4 and 2.8 percentage points from the previous month, falling below the threshold; the PMI of small enterprises was 47.9 percent, down 0.7 percentage points from last month, still below the threshold.

From the sub-indexes, among the five sub-indexes that constitute the manufacturing PMI, the supplier delivery time index was higher than the threshold, and the production index, new order index, raw material inventory index and employee index were all lower than the threshold.

The production index was 49.8 percent, down 3.0 percentage points from the previous month, falling below the threshold, indicating that manufacturing production activities have slowed down.

The new order index was 48.5 percent, down 1.9 percentage points from the previous month, falling below the threshold, indicating that the market demand of the manufacturing industry has fallen.

The raw material inventory index was 47.9 percent, down 0.2 percentage point from the previous month, indicating that the inventory of major raw materials in the manufacturing industry continued to decline.

The employment index was 48.6 percent, down 0.1 percentage point from the previous month, indicating a slight decline in the employment outlook of manufacturing enterprises.

The supplier delivery time index was 50.1 percent, down 1.2 percentage points from the previous month, still higher than the threshold, indicating that the delivery time of raw material suppliers in the manufacturing industry was slightly faster than that of the previous month.

|

China's Manufacturing PMI (Seasonally Adjusted) |

||||||

|

Unit: % |

||||||

|

|

PMI |

|

||||

|

Production Index |

New Orders Index |

Raw Materials Inventory Index |

Employment Index |

Supplier Delivery Time Index |

||

|

|

|

|

|

|

|

|

|

2021- July |

50.4 |

51.0 |

50.9 |

47.7 |

49.6 |

48.9 |

|

August |

50.1 |

50.9 |

49.6 |

47.7 |

49.6 |

48.0 |

|

September |

49.6 |

49.5 |

49.3 |

48.2 |

49.0 |

48.1 |

|

October |

49.2 |

48.4 |

48.8 |

47.0 |

48.8 |

46.7 |

|

November |

50.1 |

52.0 |

49.4 |

47.7 |

48.9 |

48.2 |

|

December |

50.3 |

51.4 |

49.7 |

49.2 |

49.1 |

48.3 |

|

2022-January |

50.1 |

50.9 |

49.3 |

49.1 |

48.9 |

47.6 |

|

February |

50.2 |

50.4 |

50.7 |

48.1 |

49.2 |

48.2 |

|

March |

49.5 |

49.5 |

48.8 |

47.3 |

48.6 |

46.5 |

|

April |

47.4 |

44.4 |

42.6 |

46.5 |

47.2 |

37.2 |

|

May |

49.6 |

49.7 |

48.2 |

47.9 |

47.6 |

44.1 |

|

June |

50.2 |

52.8 |

50.4 |

48.1 |

48.7 |

51.3 |

|

July |

49.0 |

49.8 |

48.5 |

47.9 |

48.6 |

50.1 |

|

|

|

|

|

|

|

|

|

Related Indicators of China's Manufacturing PMI (Seasonally Adjusted) |

||||||||

|

Unit: % |

||||||||

|

|

New Export Orders Index |

Import Index |

Purchase Quantity Index |

Main Raw Material Purchase Price Index |

Producer Price Index |

Finished Goods Inventory Index |

Open Orders Index |

Production And Business Activities Expectation Index |

|

|

|

|

|

|

|

|

|

|

|

2021- July |

47.7 |

49.4 |

50.8 |

62.9 |

53.8 |

47.6 |

46.1 |

57.8 |

|

August |

46.7 |

48.3 |

50.3 |

61.3 |

53.4 |

47.7 |

45.9 |

57.5 |

|

September |

46.2 |

46.8 |

49.7 |

63.5 |

56.4 |

47.2 |

45.6 |

56.4 |

|

October |

46.6 |

47.5 |

48.9 |

72.1 |

61.1 |

46.3 |

45.0 |

53.6 |

|

November December |

48.5 |

48.1 |

50.2 |

52.9 |

48.9 |

47.9 |

45.7 |

53.8 |

|

48.1 |

48.2 |

50.8 |

48.1 |

45.5 |

48.5 |

45.6 |

54.3 |

|

|

2022-January |

48.4 |

47.2 |

50.2 |

56.4 |

50.9 |

48.0 |

45.8 |

57.5 |

|

February |

49.0 |

48.6 |

50.9 |

60.0 |

54.1 |

47.3 |

45.2 |

58.7 |

|

March |

47.2 |

46.9 |

48.7 |

66.1 |

56.7 |

48.9 |

46.1 |

55.7 |

|

April |

41.6 |

42.9 |

43.5 |

64.2 |

54.4 |

50.3 |

46.0 |

53.3 |

|

May |

46.2 |

45.1 |

48.4 |

55.8 |

49.5 |

49.3 |

45.0 |

53.9 |

|

June |

49.5 |

49.2 |

51.1 |

52.0 |

46.3 |

48.6 |

44.2 |

55.2 |

|

July |

47.4 |

46.9 |

48.9 |

40.4 |

40.1 |

48.0 |

42.6 |

52.0 |

|

|

|

|

|

|

|

|

|

|

2. Non-manufacturing Purchasing Managers index

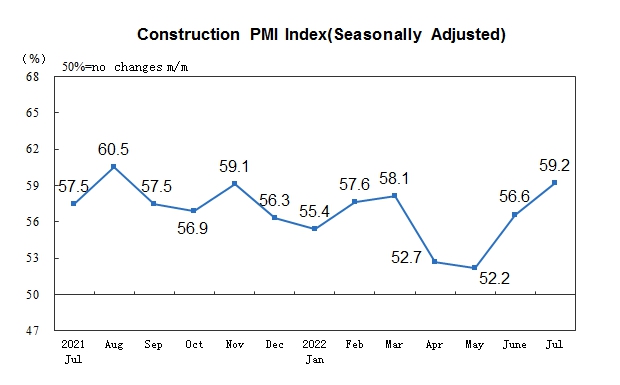

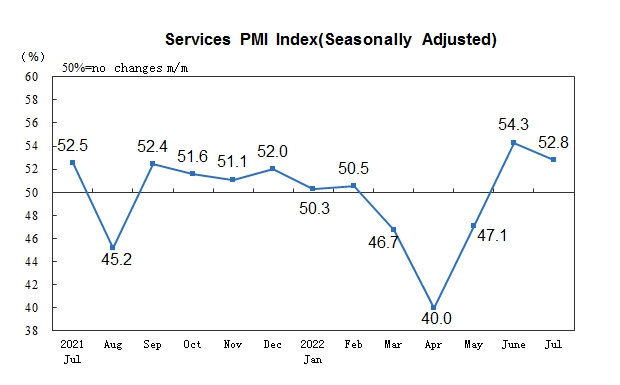

In July, the non-manufacturing business activity index was 53.8 percent, down 0.9 percentage point from the previous month, still in the expansion range, and the non-manufacturing industry resumed growth for two consecutive months.

By industry, the business activity index of the construction industry was 59.2 percent, up 2.6 percentage points from the previous month. The business activity index of the service industry was 52.8 percent, down 1.5 percentage points from the previous month. From the perspective of the industry, the business activity index of railway transportation, air transportation, accommodation, catering, telecommunications, radio and television and satellite transmission services, ecological protection and public facilities management, culture, sports and entertainment industries was in the higher boom range of more than 55.0 percent; the business activity index of capital market services, insurance, real estate, leasing and business services was below the threshold.

The new order index was 49.7 percent, down 3.5 percentage points from the previous month, falling below the threshold, indicating a slowdown in non-manufacturing market demand. By industry, the new order index of the construction industry was 51.1 percent, up 0.3 percentage point from the previous month; the index of new orders in the service industry was 49.5 percent, down 4.2 percentage points from the previous month.

The input price index was 48.6 percent, down 4.0 percentage points from the previous month and below the threshold, indicating that the overall level of input prices used by non-manufacturing enterprises for business activities decreased from the previous month. By industry, the construction industry input price index was 45.0 percent, down 3.7 percentage points from the previous month; the price index of service industry inputs was 49.2 percent, down 4.1 percentage points from the previous month.

The sales price index was 47.4 percent, down 2.2 percentage points from the previous month, and continued to be below the threshold, indicating that the overall decline in non-manufacturing sales prices has expanded. By industry, the sales price index of the construction industry was 50.2 percent, down 0.1 percentage point from the previous month; the sales price index of the service industry was 46.9 percent, down 2.6 percentage points from the previous month.

The employment index was 46.7 percent, down 0.2 percentage point from the previous month, indicating that the employment outlook of non-manufacturing enterprises has declined. In terms of industries, the construction industry employee index was 47.7 percent, down 0.6 percentage point from the previous month; the index of service industry employees was 46.6 percent, unchanged from the previous month.

The expected index of business activities was 59.1 percent, down 2.2 percentage points from the previous month, and continued to be higher than the threshold, indicating that non-manufacturing enterprises were generally optimistic about the recent market recovery and development. By industry, the expected index of business activities in the construction industry was 61.0 percent, down 2.1 percentage points from the previous month; the expected index of business activities in the service industry was 58.8 percent, down 2.2 percentage points from the previous month.

|

Main Indices of China's Non-manufacturing PMI (Seasonally Adjusted) |

||||||

|

Unit: % |

||||||

|

|

Business Activity Index |

New Orders Index |

Input Price Index |

Sales Price Index |

Employment Index |

Business Activities Expectation Index |

|

|

|

|

|

|

|

|

|

2021- July |

53.3 |

49.7 |

53.5 |

51.3 |

48.2 |

60.7 |

|

August |

47.5 |

42.2 |

51.3 |

49.3 |

47.0 |

57.4 |

|

September |

53.2 |

49.0 |

53.5 |

50.5 |

47.8 |

59.1 |

|

October |

52.4 |

49.0 |

57.8 |

52.7 |

47.5 |

58.8 |

|

November |

52.3 |

48.9 |

50.8 |

50.1 |

47.3 |

58.2 |

|

December |

52.7 |

48.4 |

49.3 |

48.1 |

47.6 |

57.3 |

|

2022-January |

51.1 |

47.8 |

52.1 |

51.0 |

46.9 |

57.9 |

|

February |

51.6 |

47.6 |

53.9 |

49.8 |

48.0 |

60.5 |

|

March |

48.4 |

45.7 |

55.9 |

51.1 |

47.1 |

54.6 |

|

April |

41.9 |

37.4 |

53.7 |

48.9 |

45.4 |

53.6 |

|

May |

47.8 |

44.1 |

52.5 |

49.4 |

45.3 |

55.6 |

|

June |

54.7 |

53.2 |

52.6 |

49.6 |

46.9 |

61.3 |

|

July |

53.8 |

49.7 |

48.6 |

47.4 |

46.7 |

59.1 |

|

|

|

|

|

|

|

|

|

Other Indices of China's Non-manufacturing PMI (Seasonally Adjusted) |

||||

|

Unit: % |

||||

|

|

Foreign New Orders Index |

Open Orders Index |

Stock Index |

Supplier Delivery Time Index |

|

|

|

|

|

|

|

2021- July |

47.7 |

44.8 |

47.3 |

51.3 |

|

August |

43.9 |

42.9 |

45.9 |

49.2 |

|

September |

46.4 |

44.2 |

45.9 |

50.4 |

|

October |

47.5 |

44.3 |

45.5 |

49.7 |

|

November |

47.5 |

43.9 |

45.6 |

50.1 |

|

December |

47.7 |

43.4 |

46.4 |

49.6 |

|

2022-January |

46.0 |

43.9 |

47.0 |

49.2 |

|

February |

48.1 |

44.1 |

46.6 |

49.8 |

|

March |

45.8 |

42.8 |

45.9 |

45.2 |

|

April |

42.7 |

41.2 |

43.9 |

42.8 |

|

May |

42.8 |

43.2 |

45.2 |

45.3 |

|

June |

50.1 |

44.5 |

46.8 |

50.8 |

|

July |

45.1 |

43.4 |

47.1 |

50.7 |

|

|

|

|

|

|

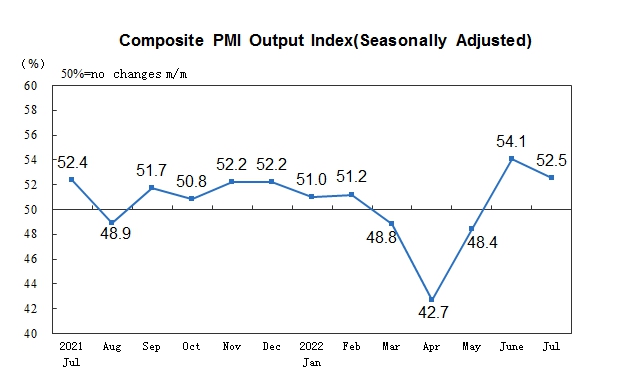

3. Composite PMI Output Index

In July, the comprehensive PMI output index was 52.5 percent, down 1.6 percentage points from the previous month, still higher than the threshold, indicating that the overall production and operation of Chinese enterprises continued to expand in a restorative manner.

Annotations:

1. Explanatory Notes

Purchasing Managers Index (PMI) is an index summarized and compiled through the results of the monthly survey of enterprises purchasing managers. It covers every links of the enterprises, including purchasing, production, logistics, and so on. It is one of the leading indices which was commonly adopted by international society to monitor the macroeconomic trends, and played an important role in forecasting and monitoring. The Composite PMI Output Index, belonging to the PMI indicator system, is a composite index reflecting the changes in the output in current period of the entire industry (manufacturing and non-manufacturing industries). The threshold of PMI is usually using 50 percent as the cut-off point for economic performance. If PMI above 50 percent, it reflects the overall economy is expanding; if less than 50 percent, it reflects the overall economy is in recession.

2. Statistical Coverage

The survey involves 31 divisions of manufacturing industry in the “Industrial Classification for National Economic Activities” (GB/T4754-2017), and 3000 samples, as well as 43 divisions of non-manufacturing industry, and 4200 samples.

3. Survey Methods

PPS (Probability Proportional to Size) sampling method was adopted in purchasing managers’ survey. Using the divisions of the manufacturing or non-manufacturing industry as the selecting strata, the sample size of each division is proportional to its proportion of the value-added of the division to the total value-added of the manufacturing or non-manufacturing industry. Within the stratum, the samples are selected according to the probabilities proportional to their principal business revenues of the enterprises.

The survey was organized and conducted by staff members of survey offices, monthly through Online Reporting System of NBS by sending survey questionnaires to the purchasing managers of the selected enterprises.

4. Calculation Methods

(1) Calculation Methods of Sub-indices.

The indicator system of manufacturing purchasing managers’ survey covers 13 sub-indices such as production, new orders, export orders, existing orders, finished goods inventory, purchase, import, purchase price, producer price, raw materials inventory, employees, suppliers, delivery time, production and business activities expectation. Non-manufacturing purchasing manager’s survey involves 10 questions on production, new orders (business required), export, existing orders, finished goods inventory, intermediate input price, subscription price, employees, suppliers’ delivery time, and business activities expectation. The indicator system of non-manufacturing purchasing managers’ survey covers 10 sub-indices such as business activities, new orders, new export orders, existing orders, finished goods inventory, intermediate input price, subscription price, employees, supplier’s delivery time, and business activities expectation. Sub-indices adopt diffusion index calculation method, i.e. percentage of positive answers in number of enterprises plus half of the percentage in the same answers. Due to the lack of synthesis of non-manufacturing integrated PMI index, the international society often used business activity index to reflect the overall changes in non-manufacturing economic development.

(2) Calculation Methods of Manufacturing PMI.

Manufacturing PMI was calculated according to five diffusion indices (group indices) and their weights. 5 group indices and their weights are determined in accordance with their leading impact on the economy. Specifically, new orders index weighted 30 percent; production index weighted 25 percent; employee’s index weighted 20 percent; supplier delivery time index weighted 15 percent; raw materials inventory index weighted 10 percent. Of which, the supplier delivery time index is a converse index, and contrary calculation is needed when combines it into PMI.

(3) Calculation Methods of Composite PMI Output Index.

Composite PMI Output Index was calculated by weighted summation of the manufacturing output index and non-manufacturing business activity index. Their weights are determined by the proportion manufacturing and non-manufacturing industries in GDP.

5. Seasonal adjustment

The purchasing managers’ survey is a monthly survey, the data of the survey fluctuates very much for the influences of seasonal factors. The released PMI composite index and sub-indices are seasonally adjusted data.