Business Climate Index Increased in the First Quarter of 2013

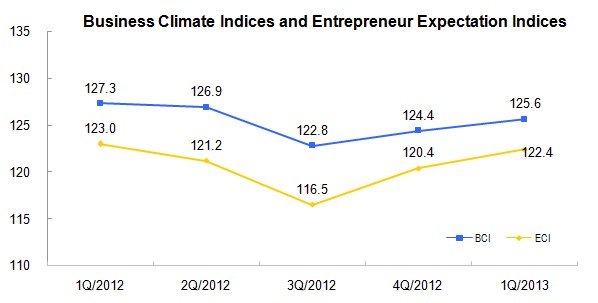

National Business Climate Survey results showed that the business climate index (BCI) was 125.6 in the first quarter of 2013, increased 1.2 points quarter-on-quarter. Of which, the current BCI that reflected the current state of business climate was 119.0, down by 5.1 points quarter-on-quarter; the expected BCI that reflected the anticipation of future business climate was 129.9, up by 5.3 points quarter-on-quarter. In the first quarter, the entrepreneur expectation index (ECI) was 122.4, up by 2.0 points quarter-on-quarter, and 3.2 points lower than BCI.

As a reflection of current and expected state of business climate, although the BCI increased slightly over that in the fourth quarter last year, it decreased 1.7 points over the same period last year, and the ECI was still significantly lower than the BCI, showing that the prosperity level of enterprises was lower over the same period last year, the state of prosperity was mild, and the entrepreneur confidence was still recovering.

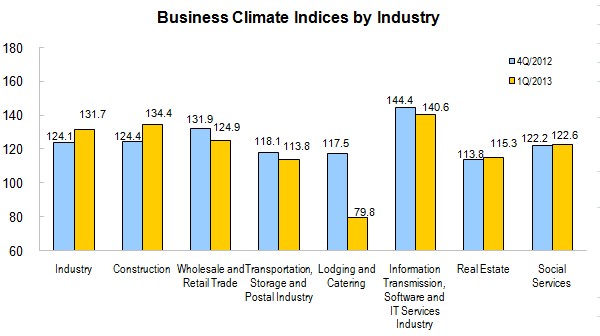

In terms of different industries, the rank of BCIs followed by the information transmission, software and IT services industry, construction, industry, wholesale and retail trade, social services, real estate, transportation, storage and postal industry, lodging and catering was 140.6, 134.4, 131.7, 124.9, 122.6, 115.3, 113.8, 79.8 respectively. As compared with the results of the fourth quarter last year, the BCIs of construction, industry, real estate, social services rose by 10.0, 7.6, 1.5 and 0.4 points respectively, that of lodging and catering, wholesale and retail trade, transportation, storage and postal industry, information transmission, software and IT services industry declined 37.7,7.0,4.3 and 3.8 points respectively.

In terms of sub-branches of the industry, the BCIs of production and supply of electricity, heat, gas and water, manufacturing, and mining industry was 138.9, 132.9 and 106.8 points, respectively. Of which, the industries with high prosperity from high to low in descending order were pharmaceutical, tobacco, beverage, food, measuring instrument and meter, automobiles, the BCIs were above 140. The industry with low prosperity was petroleum processing, the BCI were in a recession interval (the sentiment index is less than 100). As compared with the results of the fourth quarter last year, the prosperity levels of steel, non-ferrous metals, electronic products, manufacture of general-purpose machinery, special-purpose machinery rose much, that of tobacco dropped a lot.

In terms of different types of registration, the BCIs of state-owned enterprises, collective-owned enterprises, joint-stock cooperative enterprises, joint ventures, limited liability companies, cooperation limited, private enterprises, enterprises with funds from Hong Kong, Macao, and Taiwan, and foreign funded enterprises was 130.0, 112.8, 123.1, 114.5, 122.6, 133.7, 118.3, 127.9 and 126.5 points in the first quarter, respectively. As compared with the results of the fourth quarter last year, the BCIs of joint ventures, enterprises with funds from Hong Kong, Macao, and Taiwan, foreign funded enterprises, joint-stock cooperative enterprises, collective-owned enterprises, limited liability companies, state-owned enterprises, cooperation limited rose by 8.9, 7.4, 4.5, 4.5, 3.5, 1.3, 0.8 and 0.1 points respectively; that of private enterprises dropped 1.0 points.

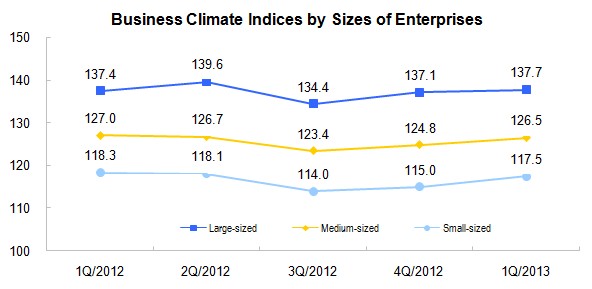

In terms of the sizes of enterprises, the BCIs of large, medium and small-sized enterprises were 137.7, 126.5 and 117.5, respectively, up by 0.6, 1.7 and 2.5 points quarter-on-quarter, respectively.

In terms of different regions, the BCIs of eastern, central and western regions stood at 125.5, 127.6 and 122.6, respectively.

Annotations:

1. Explanatory Notes

The business climate index is comprehensively reflects the economic situation and the expected direction, through out by the good or bad judgments on the business situation from the entrepreneurs from the business climate survey. The range of BCI is between 0-200, 100 as the critical value, when the index is greater than 100, reflecting the business climate state is good and optimistic, the more close to 200 the higher the level of optimism; less than 100, reflect the state of the business climate is poor and pessimistic, closer to 0 reflect deeper pessimistic.

2. Statistical Coverage

The survey covers eight sectors: industry, construction, wholesale and retail trade, transportation, storage and postal services, hotel and catering industry, information transmission, software and IT services, real estate, and social services. Each industry is according to the scale of the proportion of a sample.

3. Survey Methods

Samples were selected by adopting the sampling methods of stratified, probability proportional to size (PPS). The national total sample size were 21,000 enterprises.

4. Survey Contents

Survey involved in the business running, enterprises operation, profitability, employment, investment, financing, inventory and other production and management problems.

5. Calculation Methods

The business climate index = 0.4×Current BCI +0.6×Expected BCI

Current BCI = the proportion of good by the answer from the responsible persons in charge of the enterprise operating conditions in the current quarter - poor proportion of +100

Expected BCI = the proportion of good by the answer from the responsible persons in charge of the enterprise operating conditions in the next quarter - poor proportion of +100

6. Classification of Eastern, Central and Western Regions

Eastern regions including Beijing, Tianjin, Hebei, Liaoning, Shanghai, Jiangsu, Zhejiang, Fujian, Shandong, Guangdong, Hainan; central regions including Shanxi, Jilin, Heilongjiang, Anhui, Jiangxi, Henan, Hubei, Hunan; western regions including Inner Mongolia, Guangxi, Chongqing, Sichuan, Guizhou, Yunnan, Tibet, Shaanxi, Gansu, Qinghai, Ningxia, Xinjiang.