Purchasing Managers Index for April 2022

Department of Service Statistics of NBS

China Federation of Logistics and Purchasing (CFLP)

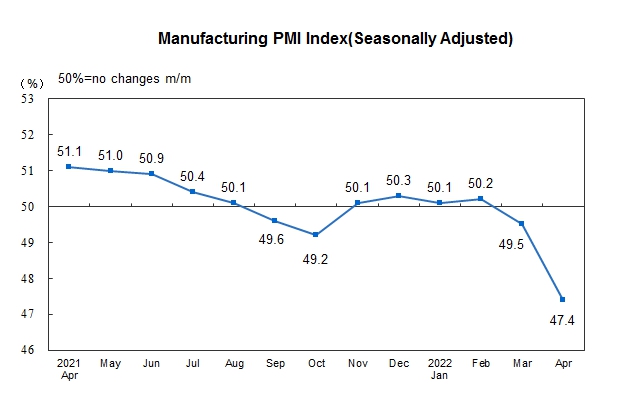

1. Manufacturing Purchasing Managers Index

In April, the Purchasing Manager Index (PMI) of China's manufacturing industry was 47.4 percent, down 2.1 percentage points from the previous month, lower than the threshold, and the overall prosperity level of the manufacturing industry fell continuously.

In terms of enterprise scale, the PMI of large enterprises was 48.1 percent, down 3.2 percentage points from the previous month and below the threshold; the PMI of small and medium-sized enterprises were 47.5 and 45.6 percent respectively, both down 1.0 percentage point from the previous month and continuing to be lower than the threshold.

From the perspective of sub-indexes, the five sub-indexes constituting the manufacturing PMI were all below the threshold.

The production index was 44.4 percent, down 5.1 percentage points from the previous month, indicating a significant slowdown in manufacturing production activities.

The new order index was 42.6 percent, down 6.2 percentage points from the previous month, indicating that the market demand of the manufacturing industry fell greatly.

The raw material inventory index was 46.5 percent, down 0.8 percentage point from the previous month, indicating that the inventory of main raw materials in the manufacturing industry continued to decrease.

The employment index was 47.2 percent, down 1.4 percentage points from the previous month, indicating that the employment climate of manufacturing enterprises has decreased.

The supplier delivery time index was 37.2 percent, down 9.3 percentage points from the previous month, indicating that the delivery time of raw material suppliers in the manufacturing industry has slowed down significantly.

|

China's Manufacturing PMI (Seasonally Adjusted) |

||||||

|

Unit: % |

||||||

|

|

PMI |

|

||||

|

Production Index |

New Orders Index |

Raw Materials Inventory Index |

Employment Index |

Supplier Delivery Time Index |

||

|

|

|

|

|

|

|

|

|

2021-April |

51.1 |

52.2 |

52.0 |

48.3 |

49.6 |

48.7 |

|

May |

51.0 |

52.7 |

51.3 |

47.7 |

48.9 |

47.6 |

|

June |

50.9 |

51.9 |

51.5 |

48.0 |

49.2 |

47.9 |

|

July |

50.4 |

51.0 |

50.9 |

47.7 |

49.6 |

48.9 |

|

August |

50.1 |

50.9 |

49.6 |

47.7 |

49.6 |

48.0 |

|

September |

49.6 |

49.5 |

49.3 |

48.2 |

49.0 |

48.1 |

|

October |

49.2 |

48.4 |

48.8 |

47.0 |

48.8 |

46.7 |

|

November |

50.1 |

52.0 |

49.4 |

47.7 |

48.9 |

48.2 |

|

December |

50.3 |

51.4 |

49.7 |

49.2 |

49.1 |

48.3 |

|

2022-January |

50.1 |

50.9 |

49.3 |

49.1 |

48.9 |

47.6 |

|

February |

50.2 |

50.4 |

50.7 |

48.1 |

49.2 |

48.2 |

|

March |

49.5 |

49.5 |

48.8 |

47.3 |

48.6 |

46.5 |

|

April |

47.4 |

44.4 |

42.6 |

46.5 |

47.2 |

37.2 |

|

|

|

|

|

|

|

|

|

Related Indicators of China's Manufacturing PMI (Seasonally Adjusted) |

||||||||

|

Unit: % |

||||||||

|

|

New Export Orders Index |

Import Index |

Purchase Quantity Index |

Main Raw Material Purchase Price Index |

Producer Price Index |

Finished Goods Inventory Index |

Open Orders Index |

Production And Business Activities Expectation Index |

|

|

|

|

|

|

|

|

|

|

|

2021-April |

50.4 |

50.6 |

51.7 |

66.9 |

57.3 |

46.8 |

46.4 |

58.3 |

|

May |

48.3 |

50.9 |

51.9 |

72.8 |

60.6 |

46.5 |

45.9 |

58.2 |

|

June |

48.1 |

49.7 |

51.7 |

61.2 |

51.4 |

47.1 |

46.6 |

57.9 |

|

July |

47.7 |

49.4 |

50.8 |

62.9 |

53.8 |

47.6 |

46.1 |

57.8 |

|

August |

46.7 |

48.3 |

50.3 |

61.3 |

53.4 |

47.7 |

45.9 |

57.5 |

|

September |

46.2 |

46.8 |

49.7 |

63.5 |

56.4 |

47.2 |

45.6 |

56.4 |

|

October |

46.6 |

47.5 |

48.9 |

72.1 |

61.1 |

46.3 |

45.0 |

53.6 |

|

November |

48.5 |

48.1 |

50.2 |

52.9 |

48.9 |

47.9 |

45.7 |

53.8 |

|

December |

48.1 |

48.2 |

50.8 |

48.1 |

45.5 |

48.5 |

45.6 |

54.3 |

|

2022-January |

48.4 |

47.2 |

50.2 |

56.4 |

50.9 |

48.0 |

45.8 |

57.5 |

|

February |

49.0 |

48.6 |

50.9 |

60.0 |

54.1 |

47.3 |

45.2 |

58.7 |

|

March |

47.2 |

46.9 |

48.7 |

66.1 |

56.7 |

48.9 |

46.1 |

55.7 |

|

April |

41.6 |

42.9 |

43.5 |

64.2 |

54.4 |

50.3 |

46.0 |

53.3 |

|

|

|

|

|

|

|

|

|

|

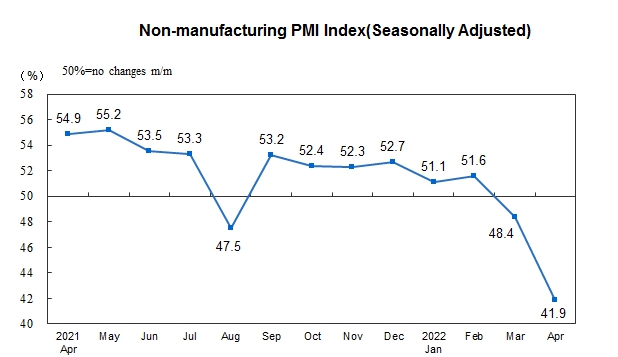

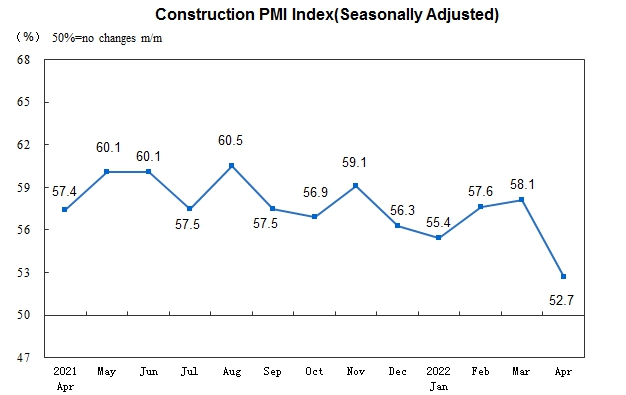

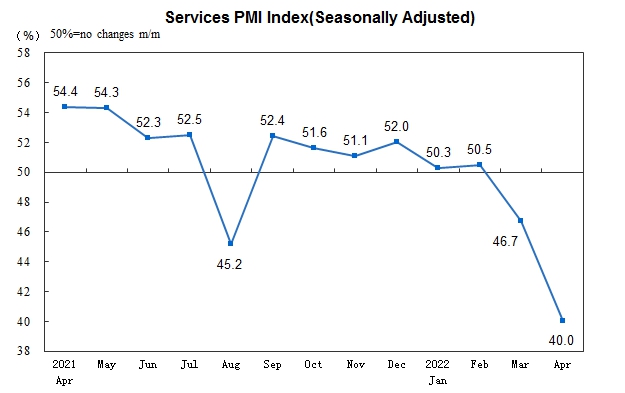

2. Non-manufacturing Purchasing Managers Index

In April, the non-manufacturing business activity index was 41.9 percent, down 6.5 percentage points from the previous month, below the threshold, and the non-manufacturing business activity continued to slow down as a whole.

By industry, the business activity index of the construction industry was 52.7 percent, down 5.4 percentage points from the previous month. The business activity index of the service industry was 40.0 percent, down 6.7 percentage points from the previous month. In terms of industry conditions, the business activity index of telecommunications, radio and television and satellite transmission services, internet software and information technology services continues to be in the expansion range; the business activity index of retail, road transportation, air transportation, accommodation, catering, real estate, resident service, culture, sports and entertainment industries was lower than the threshold.

The new order index was 37.4 percent, down 8.3 percentage points from the previous month, lower than the threshold, indicating a significant decline in non-manufacturing market demand. By industry, the new order index of the construction industry was 45.3 percent, down 5.9 percentage points from the previous month; the new order index of the service industry was 36.0 percent, down 8.7 percentage points from the previous month.

The input price index was 53.7 percent, down 2.2 percentage points from the previous month, higher than the threshold, indicating that the overall increase in the price of inputs used by non-manufacturing enterprises for business activities has narrowed. By industry, the price index of construction inputs was 60.3 percent, down 1.1 percentage points from the previous month; the price index of service inputs was 52.6 percent, down 2.3 percentage points from the previous month.

The sales price index was 48.9 percent, down 2.2 percentage points from the previous month, lower than the threshold, indicating that the overall sales price level of non-manufacturing industry has decreased. By industry, the sales price index of the construction industry was 53.2 percent, down 1.2 percentage points from the previous month; the sales price index of the service industry was 48.1 percent, down 2.5 percentage points from the previous month.

The employment index was 45.4 percent, down 1.7 percentage points from the previous month, indicating that the employment climate of non-manufacturing enterprises continued to decline. By industry, the employment index of the construction industry was 43.1 percent, down 7.0 percentage points from the previous month; the index of service industry employees was 45.8 percent, down 0.8 percentage point from the previous month.

The expected index of business activities was 53.6 percent, down 1.0 percentage point from the previous month, but higher than the threshold, indicating that most non-manufacturing enterprises were still confident in the market trend. By industry, the expected index of business activities in the construction industry was 57.0 percent, down 3.3 percentage points from the previous month; the expected index of business activities in the service industry was 53.0 percent, down 0.6 percentage point from the previous month.

|

Main Indices of China's Non-manufacturing PMI (Seasonally Adjusted) |

||||||

|

Unit: % |

||||||

|

|

Business Activity Index |

New Orders Index |

Input Price Index |

Sales Price Index |

Employment Index |

Business Activities Expectation Index |

|

|

|

|

|

|

|

|

|

2021-April |

54.9 |

51.5 |

54.9 |

51.2 |

48.7 |

63.0 |

|

May |

55.2 |

52.2 |

57.7 |

52.8 |

48.9 |

62.9 |

|

June |

53.5 |

49.6 |

53.4 |

51.4 |

48.0 |

60.8 |

|

July |

53.3 |

49.7 |

53.5 |

51.3 |

48.2 |

60.7 |

|

August |

47.5 |

42.2 |

51.3 |

49.3 |

47.0 |

57.4 |

|

September |

53.2 |

49.0 |

53.5 |

50.5 |

47.8 |

59.1 |

|

October |

52.4 |

49.0 |

57.8 |

52.7 |

47.5 |

58.8 |

|

November |

52.3 |

48.9 |

50.8 |

50.1 |

47.3 |

58.2 |

|

December |

52.7 |

48.4 |

49.3 |

48.1 |

47.6 |

57.3 |

|

2022-January |

51.1 |

47.8 |

52.1 |

51.0 |

46.9 |

57.9 |

|

February |

51.6 |

47.6 |

53.9 |

49.8 |

48.0 |

60.5 |

|

March |

48.4 |

45.7 |

55.9 |

51.1 |

47.1 |

54.6 |

|

April |

41.9 |

37.4 |

53.7 |

48.9 |

45.4 |

53.6 |

|

|

|

|

|

|

|

|

|

Other Indices of China's Non-manufacturing PMI (Seasonally Adjusted) |

||||

|

Unit: % |

||||

|

|

Foreign New Orders Index |

Open Orders Index |

Stock Index |

Supplier Delivery Time Index |

|

|

|

|

|

|

|

2021-April |

48.1 |

45.8 |

47.2 |

50.9 |

|

May |

47.6 |

44.7 |

47.2 |

50.8 |

|

June |

45.4 |

43.8 |

47.0 |

51.0 |

|

July |

47.7 |

44.8 |

47.3 |

51.3 |

|

August |

43.9 |

42.9 |

45.9 |

49.2 |

|

September |

46.4 |

44.2 |

45.9 |

50.4 |

|

October |

47.5 |

44.3 |

45.5 |

49.7 |

|

November |

47.5 |

43.9 |

45.6 |

50.1 |

|

December |

47.7 |

43.4 |

46.4 |

49.6 |

|

2022-January |

46.0 |

43.9 |

47.0 |

49.2 |

|

February |

48.1 |

44.1 |

46.6 |

49.8 |

|

March |

45.8 |

42.8 |

45.9 |

45.2 |

|

April |

42.7 |

41.2 |

43.9 |

42.8 |

|

|

|

|

|

|

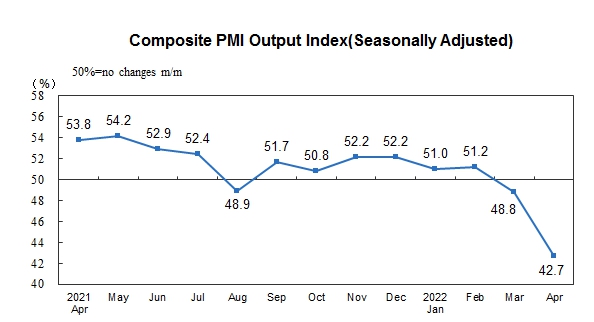

3. Composite PMI Output Index

In April, the comprehensive PMI output index was 42.7 percent, down 6.1 percentage points from the previous month, lower than the threshold, indicating that the decline in the production and operation prosperity of Chinese enterprises has increased.

Annotations:

1. Explanatory Notes

Purchasing Managers Index (PMI) is an index summarized and compiled through the results of the monthly survey of enterprises purchasing managers. It covers every links of the enterprises, including purchasing, production, logistics, and so on. It is one of the leading indices which was commonly adopted by international society to monitor the macroeconomic trends, and played an important role in forecasting and monitoring. The Composite PMI Output Index, belonging to the PMI indicator system, is a composite index reflecting the changes in the output in current period of the entire industry (manufacturing and non-manufacturing industries). The threshold of PMI is usually using 50 percent as the cut-off point for economic performance. If PMI above 50 percent, it reflects the overall economy is expanding; if less than 50 percent, it reflects the overall economy is in recession.

2. Statistical Coverage

The survey involves 31 divisions of manufacturing industry in the “Industrial Classification for National Economic Activities” (GB/T4754-2017), and 3200 samples, as well as 43 divisions of non-manufacturing industry, and 4300 samples.

3. Survey Methods

PPS (Probability Proportional to Size) sampling method was adopted in purchasing managers’ survey. Using the divisions of the manufacturing or non-manufacturing industry as the selecting strata, the sample size of each division is proportional to its proportion of the value-added of the division to the total value-added of the manufacturing or non-manufacturing industry. Within the stratum, the samples are selected according to the probabilities proportional to their principal business revenues of the enterprises.

The survey was organized and conducted by staff members of survey organizations, monthly through Online Reporting System of NBS by sending survey questionnaires to the purchasing managers of the selected enterprises.

4. Calculation Methods

(1) Calculation Methods of Sub-indices.

The indicator system of manufacturing purchasing managers’ survey covers 13 sub-indices such as production, new orders, export orders, existing orders, finished goods inventory, purchase, import, purchase price, producer price, raw materials inventory, employees, suppliers, delivery time, production and business activities expectation. Non-manufacturing purchasing manager’s survey involves 10 questions on production, new orders (business required), export, existing orders, finished goods inventory, intermediate input price, subscription price, employees, suppliers’ delivery time, and business activities expectation. The indicator system of non-manufacturing purchasing managers’ survey covers 10 sub-indices such as business activities, new orders, new export orders, existing orders, finished goods inventory, intermediate input price, subscription price, employees, supplier’s delivery time, and business activities expectation. Sub-indices adopt diffusion index calculation method, i.e. percentage of positive answers in number of enterprises plus half of the percentage in the same answers. Due to the lack of synthesis of non-manufacturing integrated PMI index, the international society often used business activity index to reflect the overall changes in non-manufacturing economic development.

(2) Calculation Methods of Manufacturing PMI.

Manufacturing PMI was calculated according to five diffusion indices (group indices) and their weights. 5 group indices and their weights are determined in accordance with their leading impact on the economy. Specifically, new orders index weighted 30 percent; production index weighted 25 percent; employee’s index weighted 20 percent; supplier delivery time index weighted 15 percent; raw materials inventory index weighted 10 percent. Of which, the supplier delivery time index is a converse index, and contrary calculation is needed when combines it into PMI.

(3) Calculation Methods of Composite PMI Output Index.

Composite PMI Output Index was calculated by weighted summation of the manufacturing output index and non-manufacturing business activity index. Their weights are determined by the proportion manufacturing and non-manufacturing industries in GDP.

5. Seasonal adjustment

The purchasing managers’ survey is a monthly survey, the data of the survey fluctuates very much for the influences of seasonal factors. The released PMI composite index and sub-indices are seasonally adjusted data.