National Real Estate Development and Sales in the First Five Months of 2021

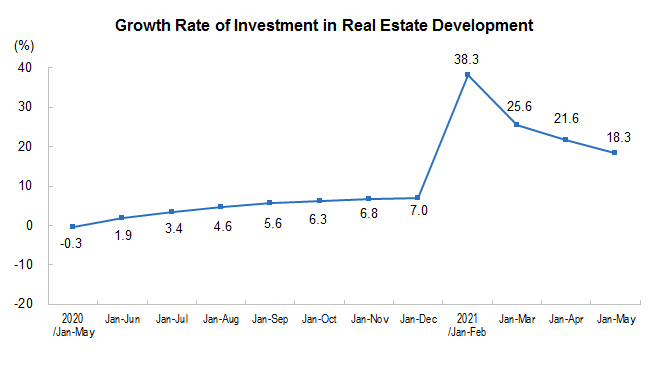

1. The completion of real estate investment

From January to May, China's investment in real estate development was 5,431.8 billion yuan, up 18.3 percent year on year; It was 17.9 percent higher than that in January to May 2019, with an average growth of 8.6 percent in two years. Among them, the residential investment was 4,075 billion yuan, an increase of 20.7 percent.

From January to May, the real estate development investment in the eastern region was 2,940.9 billion yuan, up 16.8 percent year on year; the central region invested 1,135.9 billion yuan, an increase of 25.5 percent; the western region invested 1,184.7 billion yuan, up 16.4 percent; the investment in northeast China was 170.3 billion yuan, an increase of 13.2 percent.

From January to May, the housing construction area of real estate development enterprises was 8,399.62 million square meters, a year-on-year increase of 10.1 percent. Among them, the residential construction area was 5,933.18 million square meters, an increase of 10.5 percent. The newly started housing area was 743.49 million square meters, an increase of 6.9 percent. Among them, the newly started residential area was 555.15 million square meters, an increase of 9.1 percent. The completed area of houses was 275.83 million square meters, an increase of 16.4 percent. Among them, the completed residential area was 198.8 million square meters, an increase of 18.5 percent.

From January to May, the land purchase area of real estate development enterprises was 43.96 million square meters, a year-on-year decrease of 7.5 percent; the land transaction price was 193.1 billion yuan, down 20.5 percent.

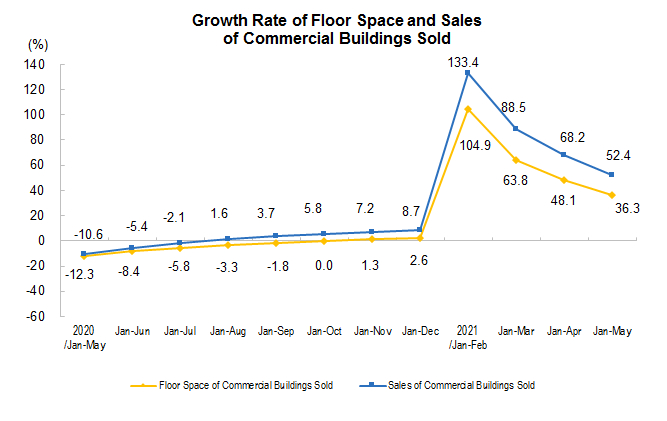

2. Sales of Commercial Buildings

From January to May, the sales area of commercial housing was 663.83 million square meters, a year-on-year increase of 36.3 percent; It was 19.6 percent higher than that from January to May in 2019, with an average growth of 9.3 percent in two years. Among them, the sales area of residential buildings increased by 39.0 percent, office buildings increased by 10.5 percent and commercial buildings increased by 8.2 percent. The sales of commercial housing reached 7,053.4 billion yuan, up 52.4 percent; It was 36.2 percent higher than that from January to May in 2019, with an average growth of 16.7 percent in two years. Among them, the sales of residential buildings increased by 56.5 percent, office buildings increased by 24.9 percent and commercial buildings increased by 10.3 percent.

From January to May, the sales area of commercial housing in the eastern region was 283.85 million square meters, a year-on-year increase of 42.5 percent; the sales volume was 4,151.1 billion yuan, up 61.8 percent. The sales area of commercial housing in central China was 180.03 million square meters, an increase of 41.3 percent; sales value reached 1,376 billion yuan, an increase of 55.3 percent. The sales area of commercial housing in the western region was 178.9 million square meters, an increase of 24.9 percent; sales value reached 1,349.7 billion yuan, up 31.0 percent. The sales area of commercial housing in northeast China was 21.06 million square meters, an increase of 22.2 percent; Sales value reached 176.6 billion yuan, up 22.3 percent.

At the end of May, the area of commercial housing for sale was 510.26 million square meters, 4.1 million square meters less than that at the end of April. Among them, the area for sale of residential buildings decreased by 3.99 million square meters, the area for sale of office buildings decreased by 130,000 square meters, and the area for sale of commercial buildings decreased by 70,000 square meters.

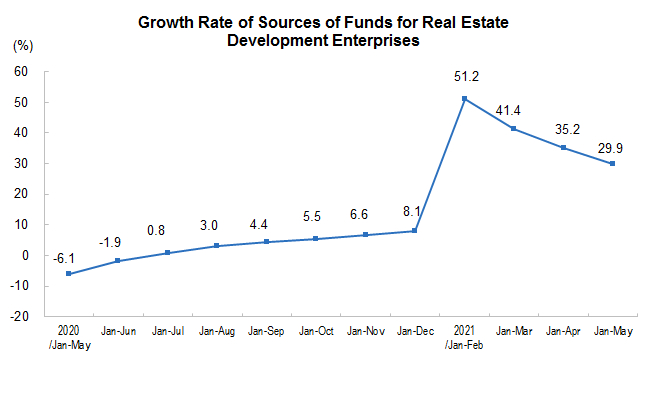

3. Sources of Funds for Real Estate Development Enterprises

From January to May, the real estate development enterprises had put in place 8,138 billion yuan, an increase of 29.9 percent year-on-year; which increased by 22.0 percent from January to May in 2019, with an average growth of 10.5 percent in two years. Among them, domestic loans amounted to 1,087.3 billion yuan, up 1.6 percent; the utilization of foreign capital was 2.5 billion yuan, down 26.5 percent; the self-raised funds amounted to 2,268.6 billion yuan, an increase of 12.8 percent; deposit and advance collection amounted to 3,173.8 billion yuan, up 62.9 percent; personal mortgage loan was 1,340 billion yuan, up 32.0 percent.

4. National Real Estate Climate Index

In May, the real estate development climate index (referred to as "national housing climate index") was 101.17.

Investment in Real Estate Development for January-May

| Indicators | Absolute Value | Growth Rate Year-on-Year (%) |

| Investment in Real Estate (100 million yuan) | 54318 | 18.3 |

| Of which: Residential Buildings | 40750 | 20.7 |

| Office Buildings | 2208 | 6.2 |

| Buildings for Commercial Business | 4591 | 6.1 |

| Floor Space under Construction (10,000 sq.m) | 839962 | 10.1 |

| Of which: Residential Buildings | 593318 | 10.5 |

| Office Buildings | 33212 | 3.4 |

| Buildings for Commercial Business | 80962 | 1.3 |

| Floor Space of Houses Newly Started (10,000 sq.m) | 74349 | 6.9 |

| Of which: Residential Buildings | 55515 | 9.1 |

| Office Buildings | 1733 | -20.3 |

| Buildings for Commercial Business | 5160 | -7.7 |

| Floor Space of Buildings Completed (10,000 sq.m) | 27583 | 16.4 |

| Of which: Residential Buildings | 19880 | 18.5 |

| Office Buildings | 947 | 7.0 |

| Buildings for Commercial Business | 2559 | -1.6 |

| Land Acquisition Area (10,000 sq.m) | 4396 | -7.5 |

| Value of Land Transactions (100 million yuan) | 1931 | -20.5 |

| Floor Space of Commercial Buildings Sold (10,000 sq.m) | 66383 | 36.3 |

| Of which: Residential Buildings | 59693 | 39.0 |

| Office Buildings | 1013 | 10.5 |

| Buildings for Business Use | 2789 | 8.2 |

| Sales of Commercial Buildings (100 million yuan) | 70534 | 52.4 |

| Of which: Residential Buildings | 64570 | 56.5 |

| Office Buildings | 1485 | 24.9 |

| Buildings for Commercial Business | 3025 | 10.3 |

| Floor Space of Commercial Housing for Sale (10,000 sq.m) | 51026 | -1.4 |

| Of which: Residential Buildings | 23312 | -4.3 |

| Office Buildings | 3674 | -3.9 |

| Buildings for Commercial Business | 12733 | -3.0 |

| Sources of Funds for Real Estate Development Enterprises (100 million yuan) | 81380 | 29.9 |

| Of which: Domestic Loans | 10873 | 1.6 |

| Foreign Investment | 25 | -26.5 |

| Self-raising Funds | 22686 | 12.8 |

| Deposits and Advance Payments | 31738 | 62.9 |

| Personal Mortgage | 13400 | 32.0 |

Real Estate Investment in Eastern, Central and Western Regions for January-May

| Regions | Investment (100 million yuan) | Growth Rate Y/Y (%) | ||

| Residential Buildings | Residential Buildings | |||

| National Total | 54318 | 40750 | 18.3 | 20.7 |

| Eastern | 29409 | 21450 | 16.8 | 18.9 |

| Central | 11359 | 9128 | 25.5 | 28.9 |

| Western | 11847 | 8863 | 16.4 | 18.7 |

| Northeastern | 1703 | 1309 | 13.2 | 11.7 |

Sales of Commercial Buildings in Eastern, Central and Western Regions for January-May

| Regions | Floor Space of Commercial Buildings Sold | Sales of Commercial Buildings | ||

| Absolute Value (1000 Sq.m) | Growth Rate Y/Y (%) | Absolute Value (100 million yuan) | Growth Rate Y/Y (%) | |

| | | | | |

| National Total | 66383 | 36.3 | 70534 | 52.4 |

| Eastern | 28385 | 42.5 | 41511 | 61.8 |

| Central | 18003 | 41.3 | 13760 | 55.3 |

| Western | 17890 | 24.9 | 13497 | 31.0 |

| Northeastern | 2106 | 22.2 | 1766 | 22.3 |

Annotations:

1. Explanation of Indicator

The total investment in real estate development this year: refers to the investment of all construction projects for housing, land development projects, public welfare construction and land acquisition costs in the reporting period. The index is cumulatively statistical data based on the principle of image progress.

Area of commercial buildings sold: refer total areas sold of new commercial buildings in the contract during the reporting period (i.e. area of floor space designated in the formal contract signed by both sides). The indicator is cumulative data.

Value of commercial buildings sold: refers to the total contracted vale of new commercial buildings for sale during the reporting period (i.e. the total value of sales for selling of commercial building as designated in the formal contract signed by both sides). This indicator is cumulative data, as well as the sale of floor space of commercial buildings.

Saleable area of commercial housing: refers to the construction area of commercial housing that has been completed for sale or rental at the end of the reporting period, including the building area completed in previous years and completed in the current period, but does not include the completed demolition and reconstruction, unified construction, public supporting buildings, self-use and revolving houses of real estate companies that cannot be sold or leased area of rental housing.

The sources of funds for real estate development enterprises in the year: refers to various currencies and sources of real estate development funds actually available by the real estate development enterprises in the reporting period. Specifically, it includes domestic loans, foreign investment, self-raised funds and other funds. The index is cumulative data.

Floor space of buildings under construction: refers to the total floor space of all buildings by the real estate development enterprises during the reference time. Including floor space newly started in current year, floor space of continued construction of the building from the former period, floor space of stopped or postponed in the previous period but recovered in current year, floor space completed during current year, and newly started floor space in current year but postponed. Floor space under construction of multi-story buildings refers to the total floor space of all stories.

Floor space of houses newly started: refers to floor space of houses newly started by the real estate development enterprises during the reference time, the unit project as the accounting object. Not including continued construction area of housing which started in the previous period, and restarted construction area in the current year but stopped or postponed in the previous period. Specific due date is subject to starts to housing officially began ground-breaking gouge (ground treatment or permanent piles). Floor space of houses newly started refers to the entire floor spaces of whole building; the calculation cannot be separated.

Floor space of buildings completed: refers to housing construction during the reporting period have been completed in accordance with design requirements, achieved to living and conditions of use, acceptance of accreditation standards or to the final acceptance, total building areas could formally hand over to be used.

Land acquisition area: refers to land area by the real estate development enterprises in the year through various ways to obtain land.

Value of land transactions: refers to final amount of transactions of land use rights by the real estate development enterprises. In the primary land market, refers to the final section of land allocation, "auction" price and sale price; the secondary land market, refers to the finalized contract price on land transfer, lease, mortgage, etc. Price of land transactions and land acquisition area are the same scope, December calculate the average purchase price of land.

2. Statistics Coverage

All real estate development and corporate business units.

3. Survey Methods

A comprehensive survey was conducted monthly (no report in January).

4. Brief Description on National Real Estate Climate Index

The national real estate climate index follows the theory of economic cycle fluctuation, based on the business cycle theory and business cycle analysis, using time series, multivariate statistics, econometric analysis, taking real estate development and investment as the benchmarks, selecting related indicators such as real estate investment, capital, area, sales, excluding the impact of seasonal factors, including random factors, compiled by adopting the growth rate cycles method. The historical data will be revised monthly according to the newly added data. National real estate index selected year 2012 as the base year, and its growth rate was set at 100. Typically, the most appropriate level of national real estate climate index is 100, the moderate level is between 95 and 105, the lower level is below 95, and the higher level is above 105.

5. Division on Eastern, Central, Western and Northeastern Regions

Eastern region includes Beijing, Tianjin, Hebei, Shanghai, Jiangsu, Zhejiang, Fujian, Shandong, Guangdong, and Hainan. Central region includes Shanxi, Anhui, Jiangxi, Henan, Hubei, and Hunan. Western region includes Inner Mongolia, Guangxi, Chongqing, Sichuan, Guizhou, Yunnan, Tibet, Shaanxi, Gansu, Qinghai, Ningxia, and Xinjiang. Northeastern region includes Liaoning, Jilin, and Heilongjiang.

6. The average growth rate of two years refers to the growth rate calculated by geometric average method based on the corresponding number of the same period in 2019.