Investment in Fixed Assets from January to July 2020

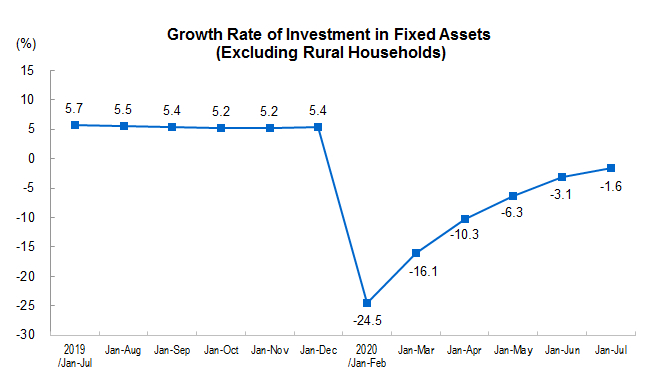

From January to July, China's investment in fixed assets (excluding rural households) was 32,921.4 billion yuan, a year-on-year decrease of 1.6 percent, and the decline rate was 1.5 percentage points lower than that in January to June. Among them, the investment in private fixed assets was 18,418.6 billion yuan, down 5.7 percent and the decline rate was 1.6 percentage points narrower. From a month on month rate, the fixed asset investment (excluding rural households) increased by 4.85 percent in July.

In terms of industries, the investment in the primary industry was 980.6 billion yuan, an increase of 7.7 percent year-on-year, 3.9 percentage points higher than that in January to June; the investment in the secondary industry was 10,011.9 billion yuan, down 7.4 percent, with a decrease rate of 0.9 percentage point narrower; the investment in the tertiary industry was 21,928.9 billion yuan, an increase of 0.8 percent, and a decrease of 1.0 percent in January to June.

In the secondary industry, industrial investment decreased by 6.5 percent year on year, 0.9 percentage point lower than that in January to June. Among them, the investment in mining industry decreased by 11.9 percent, and the decline rate expanded 8.0 percentage points; the investment in manufacturing industry decreased by 10.2 percent, and the decline rate was narrowed by 1.5 percentage points; the investment in power, heat, gas and water production and supply industry increased by 18.0 percent, and the growth rate dropped by 0.2 percentage point.

In the tertiary industry, infrastructure investment (excluding power, heat, gas and water production and supply) decreased by 1.0 percent year-on-year, 1.7 percentage points lower than that in January to June. Among them, the investment in water conservancy management industry increased by 2.9 percent and the growth rate increased by 2.5 percentage points; the investment in public facilities management industry decreased by 5.2 percent, and the decline rate was narrowed by 1.0 percent; the investment in road transportation and railway transportation increased by 2.4 and 5.7 percent respectively, with the growth rate increased by 1.6 and 3.1 percent respectively.

In terms of regions, the investment in the eastern region increased by 0.5 percent year-on-year, and which decreased by 0.7 percent in January to June; the investment in the central region decreased by 9.0 percent, and the decline rate narrowed by 2.9 percentage points; the investment in the western region and northeast China increased by 2.1 and 1.4 percent respectively, and the growth rate increased by 1.0 percentage point.

According to the type of registration, the investment of domestic enterprises decreased by 1.8 percent year-on-year, 1.6 percentage points narrower than that in January to June; the investment of Hong Kong, Macao and Taiwan enterprises increased by 1.5 percent, and the growth rate increased by 0.9 percentage point; the investment of foreign enterprises increased by 3.5 percent, and the growth rate decreased by 0.4 percentage point.

| Investment in Fixed Assets from January to July 2020

|

| |

| Indicators | Jan-Jul |

|

| Increase rate Y/Y (%) |

| |

|

| ||

| Investment in Fixed Assets (Exclude Rural Households) (100 million yuan) | -1.6 |

|

| Of which: State-owned and State Holding | 3.8 |

|

| Of which: Private Investment | -5.7 |

|

| Grouped by Constitution |

|

|

| Construction and Installation | -2.3 |

|

| Purchase of Equipment and Instruments | -11.8 |

|

| Other Expenses | 8.3 |

|

| Grouped by Types of Industry |

|

|

| Primary Industry | 7.7 |

|

| Secondary Industry | -7.4 |

|

| Tertiary Industry | 0.8 |

|

| Grouped by Industrial Sectors |

|

|

| Agriculture, Forestry, Animal Husbandry and Fishery | 9.2 |

|

| Mining | -11.9 |

|

| Manufacturing | -10.2 |

|

| Of which: Processing of Food from Agricultural Products | -13.7 |

|

| Manufacture of Foods | -9.5 |

|

| Manufacture of Textile | -17.4 |

|

| Manufacture of Chemical Raw Material and Chemical Products | -13.6 |

|

| Manufacture of Medicines | 14.7 |

|

| Smelting and Pressing of Non-Ferrous Metal | -6.5 |

|

| Manufacture of Fabricated Metal Products | -15.5 |

|

| Manufacture of General Purpose Machinery | -16.9 |

|

| Manufacture of Special Purpose Machinery | -11.5 |

|

| Manufacture of Automobile | -19.9 |

|

| Manufacture of Railways, Shipbuilding, Aerospace and Other Transportation Equipment | -14.2 |

|

| Manufacture of Electrical Machinery & Equipment | -14.1 |

|

| Manufacture of Telecommunications Equipment, Computers and Other Electronic Equipment | 10.7 |

|

| Production and Supply of Electricity ,Gas and Water | 18.0 |

|

| Transport, Storage and Post | 0.9 |

|

| Of which: Railway Transportation | 5.7 |

|

| Road Transportation | 2.4 |

|

| Management of Water Conservancy, Environment and Public Facilities | -3.8 |

|

| Of which: Management on Water Resource | 2.9 |

|

| Management on Public Facilities | -5.2 |

|

| Education | 13.5 |

|

| Health, Social Works | 17.0 |

|

| Culture, Sports and Entertainment | -2.8 |

|

| Grouped by Registration Type |

|

|

| Domestic Funded | -1.8 |

|

| Funds from Hong Kong, Macao and Taiwan | 1.5 |

|

| Foreign Investment | 3.5 |

|

|

| ||

| Note: The growth rate in this table are all nominal growth rate without deducting the price factor. |

| |

Annotations:

1. Explanatory Notes on Indicators

Investment in fixed assets (excluding rural households): refers to the total workload on construction and purchase for fixed assets during a certain period in the form of currency, as well as the concerning expenses.

Stat-holding Enterprises: including absolutely state-holding enterprises, relatively state-holding enterprises and consultatively state-holding enterprises. Absolutely state-holding enterprises refer to those enterprises that the proportion of state investment capital to the total actual capital (or capital stock) is larger than 50 percent.

Relatively state-holding enterprises refer to those enterprises that the proportion of state investment capital to the total actual capital (or capital stock) is less than 50 percent, but larger than any other single shareholders. Consultatively state-holding enterprises refer to those enterprises that the proportion of state investment capital to the total actual capital (or capital stock) is less than other shareholders, but owning the real control power regulated by agreement.

The enterprises which the proportion of investment capital of the two investors is 50 percent, and the shareholding control power is not clearly stated by either side, if one of them is state-owned, are all classified as the state-holding enterprises without exception.

The investment projects invested by the administrative and institutional units are all classified as state-holding.

Types of Registration: the types of registration on the enterprises are based on the Provisions for the Classification of Types of Enterprise Registration jointly issued by NBS and State Administration of Industry and Commerce. And that on the individual operation is based on Note on the Code & Classification of Types of Individual Operation Registration.

According to the provision of statistical reporting system, all grassroots units shall fill in registration types. The registration types shall be filled in by the enterprises or individual operation units engaged in investment in fixed assets. Those who have already registered in the industrial and commercial administrative units, shall fill in based on the registration types, if unregistered, shall be filled in based on the registration types of investors or that on the provisions of related papers.

Domestic enterprise includes state-owned enterprise, collective enterprise, joint enterprise, limited liability enterprise, share-holding enterprise, private enterprise and others.

Enterprises with funds from Hong Kong, Macao and Taiwan includes joint-venture and cooperation by Hong Kong, Macao and Taiwan, Hong Kong, Macao and Taiwan Sole Investment, Hong Kong, Macao and Taiwan Funded Share-holding Corporations Ltd., and other investment enterprises by Hong Kong, Macao and Taiwan.

Foreign investment enterprise includes joint-venture and cooperation enterprises, foreign funded enterprise, foreign funded share-holding corporations Ltd., and other foreign investment enterprises.

2. Statistical Coverage

Refers to construction projects on fixed assets and real estate involving a total planned investment of 5 million yuan and over.

3. Data Collection

The report of investment on fixed assets is collected monthly with complete enumeration (no report in January).

4. Classification on East, Central and West Region

Eastern region: including Beijing, Tianjin, Hebei, Shanghai, Jiangsu, Zhejiang, Fujian, Shandong, Guangdong and Hainan. Central region: including Shanxi, Anhui, Jiangxi, Henan, Hubei and Hunan. Western region: including Inner Mongolia, Guangxi, Chongqing, Sichuan, Guizhou, Yunnan, Tibet, Shaanxi, Gansu, Qinghai, Ningxia and Xinjiang. Northeastern region: including Liaoning, Jilin and Heilongjiang.

5. Standard Industrial Classification

NBS performed the industrial classification for national economic activities (GB/T 4754-2017).

6. Revision on Month-on-Month Data

According to the auto-revision function of the seasonal adjustment model, the month-on-month growth rate of investment on fixed assets from July 2019 has been revised as follows:

| The Month-on-Month Growth Rate of Investment on Fixed Assets (Excluding Rural Households)

| |

| Growth Rate (%) | |

| 2019-July | 0.43 |

| August | 0.42 |

| September | 0.44 |

| October | 0.41 |

| November | 0.40 |

| December | 0.40 |

| 2020-January | -4.91 |

| February | -21.02 |

| March | 6.07 |

| April | 5.92 |

| May | 5.23 |

| June | 5.06 |

| July | 4.85 |

7. Explanation of Year-on-Year Growth

According to the results of statistical law enforcement inspection and the fourth national economic census unit inventory, the fixed assets investment base in the previous year was revised, and the growth rate was calculated on comparable basis.